![]()

![]()

QuickBook users need to use Transaction Pro Importer (TPI) 4.0 (or higher) from www.baystateconsulting.com to convert the data into QuickBooks format. You need to have QuickBooks and Transaction Pro Importer running on the same PC.

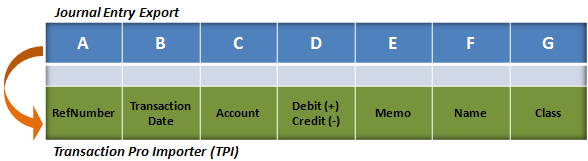

The format of the Journal Entry Export files is as follows. The following columns in the Journal Entry Export file map to these columns in TPI.

Below is a brief description of the TPI column headers. Complete descriptions can be found in the TPI Help utility.

|

Header |

Description |

|

RefNumber |

Rows with the same reference number are related journal entry transactions: e.g. Sales and Payments. Note: All related journal entry transactions must balance: i.e. the credits and debits must zero out. That is why...

|

|

Transaction Date |

The date the export is run. |

|

Account |

The name of the QuickBooks Accounts the journal entry is to be recorded against. Users can use the CORESense assigned Account names or map these Account names to their existing QuickBooks Accounts using the Chart of Accounts Import and Account Mapping utilities. |

|

Debit (+) Credit (-) |

The journal entry to be recorded against the Account |

|

Memo |

Used for Sales Tax to specify the payee which is an optional field in the export. |

|

Name |

Not used |

|

Class |

Used to specify the Class in QuickBooks. In QuickBooks, classes give you a way to classify your transactions. Users can use QuickBooks classes to classify their income and expenses by CORESense Channel and/or Brand. |

Follow the steps below to setup Transaction Pro Importer to work with an exported Journal Entry file.

|

Step |

Action |

|

1 |

Open the Transaction Pro Importer 4.0 application. |

|

2 |

Under the Program Options > Advanced tab, select “Specify a single column for Debit/Credit instead of separate columns” for Journal Entries in Transaction Pro Importer 4.0. |

|

3 |

Under the Program Options > Basic tab > Import Options in Transaction Pro Importer 4.0, select “Validate file before importing – attempt to first save each transaction (catches most errors)”. When doing Journal Entries all entries must balance, that is, the debits must equal the credits for a given transaction type. For instance, all Sales must equal all Payments including A/R, COGS must equal Inventory, and Shipping Costs must equal Shipping expenses. This selection checks to make sure all entries are equal before importing. |

© 2023 CORESense · info@coresense.com · 125 High Rock Avenue, Saratoga Springs, NY 12866