![]()

![]()

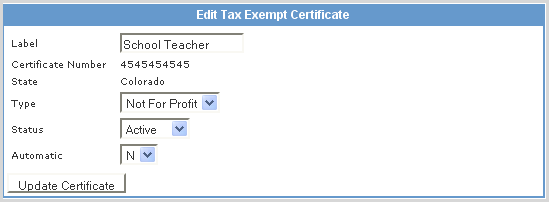

Sales tax can be refunded to customer's that have a tax exempt certificate associated with their customer record. Tax Exempt certificates are added from within the Customer Manager > Tax Exempt tab.

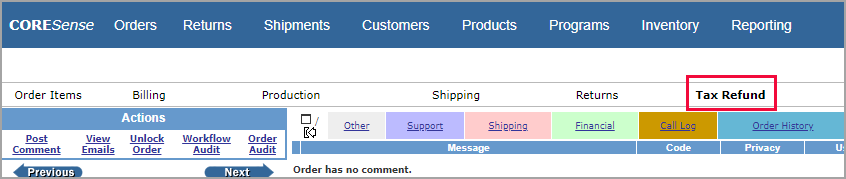

To refund sales tax, go to the order and click on the Tax Refund tab.

|

Step |

Action |

|

1 |

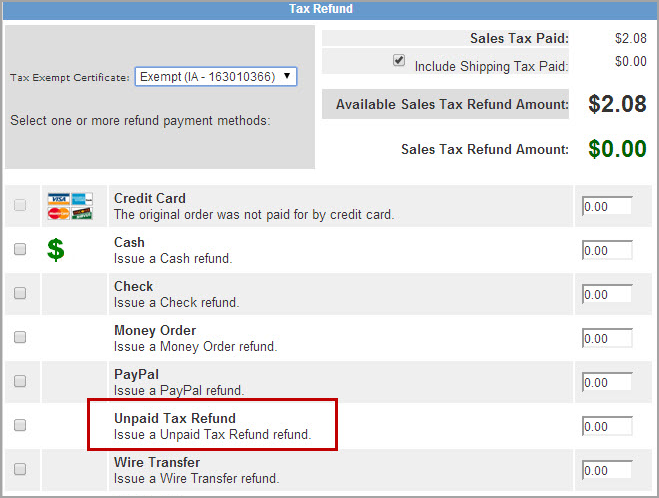

Select the certificate from the drop-down list.

|

|

2 |

Verify available amount of tax that can be refunded. |

|

3 |

Check the refund payment type and the amount will populate in that amount field.

|

|

4 |

Click on the Apply Certificate button to process refund. |

|

5 |

The system confirms refund in tab.

|

|

6 |

Verify Exemption in the order's Transaction Summary.

|

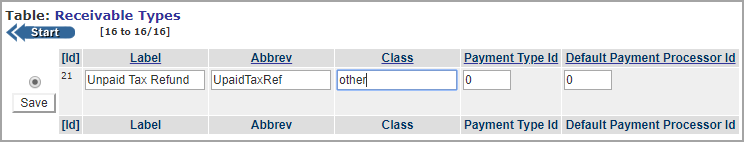

Unpaid Order (On Account) Tax Refund

For orders that have not yet been fully paid or an On Account order, you need to add another Receivable Type to the Technical Configuration table. Adding the new Receivable Type provides an option in the Tax Refund wizard that allows the sales tax amount to be subtracted from the order's remaining balance due.

Once the new receivable type is added it is available from within the Order Manager > Tax Refund wizard. Select the new type and the tax is removed from the order's due balance and the sales tax line in the transaction summary is designated as "Exempt." The certificate still needs to be identified. This can be used for any unpaid orders regardless of shipped or not shipped.

© 2023 CORESense · info@coresense.com · 125 High Rock Avenue, Saratoga Springs, NY 12866